Hello friends, in this article we are discussing on how to

check TCS deposited in PAN. If your income tax is deducted on source and you

want to know that the amount is deposited to PAN account or not then you can

easily do it.

We all know that TDS is deducted from many platform like

deduction of income tax by employer, deduction of tax by bank on FD,RD etc. and

other deductions on various financial platforms. After deduction of tax they

deposited it to individual PAN account.

But if we want to check the TDS deposited to PAN account or

not, then how to check TDS deposited in PAN? In this article we are discussing

the process of how to know TDS credited to PAN or not. If you are also

searching for this topic then read this article till end.

How to

check TDS deposited in PAN:

Before going to check tax deposited to PAN account you have

to register in income tax website first. If you have already registered in

income tax website then follow the following steps.

STEP 1: Go to https://www.incometax.gov.in and open

the home page of the website.

STEP 2: Click

on the ‘login’ button on the top bar of the page.

STEP 3: In this

page you are asked to enter your PAN number. Enter your PAN number and click on

‘Continue’.

As you click on ‘continue’ you will redirected to another

page, here you need to trick on the box before the term ‘please confirm your

secure access message displayed above’.

Then enter your password and click on ‘continue’.

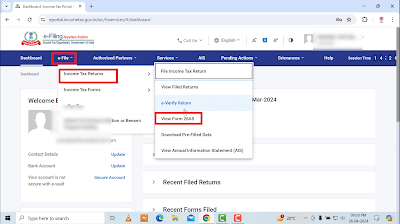

STEP 4: Now you

are logged in to your account. You will see an ‘e-file’ tab on the top bar of

the page. Place the cursor on it.

As you placed cursor on ‘e-file’ some more options will be

appeared. Place the cursor on the first option ‘income tax return’. Then again

another some options will be appeared under the ‘Income Tax Return’. Click on ‘view

form 26AS’ form the options.

STEP 5: A pop

up message will be displayed on the screen. It will tell you that you will be

redirected to anther website outside the income tax website. Click on ‘confirm’

button here.

STEP 6: Now you

will be on the TRACES website. Another pop up message will show on the screen.

You need to trick on the box before ‘I agree the usage and acceptance form

16/16A generated from TRACES.’ Trick on the box and click on ‘Proceed’ link.

STEP 7: On this

page you will see a link ‘View tax credit (form 26AS/annual tax statement’.

Click on this link here.

STEP 8: Here you

have to select your assessment year for which you want to check the tax

credited statement. You should know that the assessment year one year after the

financial year. Suppose you want to check the tax credited details for the

financial year 2023-24 then your assessment year will be 2024-25. Hence select

your assessment year as like this example.

Then select the ‘View as’ option as ‘HTML’. Now click on ‘View/download’

link.

STEP 9: Now

your tax credit statement will be appeared on the screen.

This is the process how to check TDS credited in PAN or not.

This process can also be watch on the following video. In this video we have

discussed the same process as above. If you like the video tutorial then watch

the video till end.

0 Comments